Subscribe to Our Newsletter

Special Offer from PM Press

Now more than ever there is a vital need for radical ideas. In the four years since its founding - and on a mere shoestring - PM Press has risen to the formidable challenge of publishing and distributing knowledge and entertainment for the struggles ahead. With over 200 releases to date, they have published an impressive and stimulating array of literature, art, music, politics, and culture.

PM Press is offering readers of Left Turn a 10% discount on every purchase. In addition, they'll donate 10% of each purchase back to Left Turn to support the crucial voices of independent journalism. Simply enter the coupon code: Left Turn when shopping online or mention it when ordering by phone or email.

Click here for their online catalog.

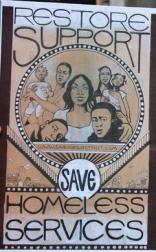

Tax the Rich, Save our Safety Net!

Victory: On September 20, 2011, the DC city council voted to increase taxes on residents making over $350,000 a year by approximately .5%. By finally creating a new tax bracket targeting high-income earners the council acceded to the demand of Save Our Safety Net, DC! (SOS) and other local advocates who together have been fighting for a more progressive tax system in the district. It was a strange victory for the coalition as there was no grassroots mobilization in the days leading up to the surprise vote. Nor was there any guarantee that the more than $100 million in new revenue over the next four years would go towards rebuilding the city’s safety net. Still, there’s no doubt that the groundwork for the vote was laid by the SOS campaigns over the past two and a half years. Perhaps most pleasing was the sight of the most conservative, anti-tax members of the council squirming and bitterly whining as the proposal they had fought so hard to avert was finally put into law.

Victory: On September 20, 2011, the DC city council voted to increase taxes on residents making over $350,000 a year by approximately .5%. By finally creating a new tax bracket targeting high-income earners the council acceded to the demand of Save Our Safety Net, DC! (SOS) and other local advocates who together have been fighting for a more progressive tax system in the district. It was a strange victory for the coalition as there was no grassroots mobilization in the days leading up to the surprise vote. Nor was there any guarantee that the more than $100 million in new revenue over the next four years would go towards rebuilding the city’s safety net. Still, there’s no doubt that the groundwork for the vote was laid by the SOS campaigns over the past two and a half years. Perhaps most pleasing was the sight of the most conservative, anti-tax members of the council squirming and bitterly whining as the proposal they had fought so hard to avert was finally put into law.

For more than two years, SOS has campaigned for a progressive income tax structure to generate the revenue necessary to save Washington DC’s vital human services. Safety net services have lost 33% of their funding in the last four years while at the same time corporate entities like luxury hotels have been awarded millions in tax abatements. Using diverse partnerships and creative tactics, SOS has been changing the public conversation around budget cuts, and providing opportunities for many more DC residents to shape the budget.

In previous budget battles, SOS utilized the strength of grassroots organizing to encourage both safety net users and people with privilege to fight for raising taxes on high-income earners in order to create revenue that would protect the safety net. In so doing, they won the votes of five DC Councilmembers in favor of progressive revenue. These city leaders even donned capes and were proclaimed “safety net super heroes” by SOS. The problem was that two more Councilmembers were needed to save DC’s struggling human services budget. In the end, SOS wasn’t able to muster the votes needed to pass the increase in taxes in May 2010 or again in November during an emergency council session that arose due to a budget shortfall.

As the fight around the FY2012 budget emerged in early 2011, members of SOS were optimistic that the newly-elected Mayor Vincent Gray would introduce income taxes into his proposed budget if some well-directed grassroots pressure pushed him in the right direction. Given the short amount of time there was to impact the mayor’s budget proposal, SOS launched a “Sway Gray” campaign which focused on a few key ways to influence him. SOS utilized statements the mayor had previously made about raising taxes to expose his apparent reluctance to propose increases. At one point he said “everything is on the table,” as it relates to budget cuts, which included the city services essential to struggling families. So SOS led a weeklong series of lunches at the mayor’s office demanding that he “take the safety net off the table!”

Each day members of SOS visited the mayor with lunch and letters asking him to introduce new tax brackets of 9% for income over $100,000, 9.5% for income over $200,000 and 10% for $500,000 and up. Currently DC’s highest income bracket is at $40,000, meaning you get taxed at the same level if you make $41,000 or $4.1 million! By the end of the week more than 60 DC residents, service providers and safety net users were chanting outside the mayor’s office. Members of SOS sat down for a grand style picnic, offering 6 foot subs and 3 layer cake as an alternative to safety net service cuts.

Not Enough

In the days leading up to the delivery of the three-tiered cake, the mayor’s budget office was distancing itself further and further from the idea of income tax—but on April 1 Mayor Gray introduced an income tax as part of his budget. Unfortunately, it wasn’t enough to be cause for celebration. On the one hand, it included a new income tax bracket of 8.9% which would kick in at $200,000; on the other hand, it also included $133 million in cuts to safety net services. SOS’s campaign strategy had been to secure a progressive income tax structure IN ORDER to save the safety net. The tax increase was there but social services had been slashed continuing a legacy of disproportionate safety net cuts to address city-wide budget shortfalls.

After several council and coalition meetings we realized that strategic alliances were the key to restoring the safety net and securing the proposed income taxes. Through bi-monthly SOS strategy sessions, activists and community members were engaged, educated, and empowered about the basics of the budget.

SOS also worked with partners in a series of creative actions. First up was a “Housing for All” Rally that challenged the drastic proposed cuts to affordable housing and the Housing Protection Trust Fund. Then on May 18, just a week before the budget vote, members mobilized 250 people to converge on City Hall for a “Safety Net Reality Tour.” This enormously successful event came on the heals of a homeless march, and garnered media attention for some of the personal stories of budget cuts affecting DC residents and the services they rely on. The City Hall exhibit was designed to engage Councilmembers and remind them that restorations were needed to keep DC residents safe, housed, and healthy.

The Reality Tour closed with a fascinating visit to the office of Council Chairman Kwame Brown, who had made clear that he intended to strip income tax increases from the budget. As DC residents railed against the cuts and called for new taxes outside his office, the Chairman finally emerged to address the crowd. He asserted that he would find a way to restore the worst cuts in the proposed budget – especially those related to homeless services – but refused to make a commitment around raising taxes for high-income earners. As the crowd booed and repeated their call for new taxes, a woman standing next to Brown asked, “How are you going to pay for it?!” The question continued to linger in the air after Brown turned his back and disappeared into his office.

Superhero Intervention

The last few weeks of each year’s budget battle have included surprising twists and turns. Council allies start to falter, surprising new alliances emerge, and last minute changes slowly leak to the public. One of the values of SOS’s organizing is that it turns leaked details normally only heard by a few political insiders into occasions for public outcry. When SOS heard that some of its budget “superheroes” were turning on them, activists carried out a Superhero Intervention with 100 other people just days before the budget vote. The local Fox news was on-hand to cover the superheroes’ effort to save the day.

Ultimately, SOS failed to undo many of the cuts, and once again a more just income tax system was not implemented as part of the budget. However, SOS did score some major wins. The worst of the cuts – ones that would have closed shelters for over 1,500 single individuals and cut cash assistance for families and the disabled – were restored. A number of other progressive revenue measures were passed, such as requiring corporations to pay taxes on the money they make in DC and not file it in a state with a lower tax rate. The city also will now limit on the itemized deductions that families with incomes over $200,000 can claim. Both measures close tax loopholes that cost the city money and let those who are most able to pay, off the hook. In addition, the DC Council committed that any revenue increase beyond projections will to go fund important city programs like affordable housing, child mental health, and childcare vouchers.

Moreover, while states like Wisconsin and Ohio are primarily targeting union jobs and service cuts, DC has been forced to reframe the debate as one of cuts vs. progressive revenue, the latter increasingly gaining ground. A poll released in May showed that 70% of residents believe that it is more important to preserve services than to hold down taxes. The budget has become a social justice issue in DC, with groups as diverse as the Washington Peace Center and service providers like So Others Might Eat spreading the word and attending SOS’s creative actions.

By participating in four budget fights over two years, SOS has challenged the business-as-usual attitudes of both government officials and paid advocates. DC is known as a city that is weak on grassroots organizing and heavy on professional advocates, so the more radical style and tactics of SOS have not always been well received. However, the success of the campaign to introduce a new high-income tax bracket in DC will surely change those views.

At this point, the future of SOS is uncertain, but the need for continued militancy around budget issues remains. In particular, organizers in DC, as well as others committed to struggles over local budget issues, must continue to work to change the narrative around safety net services and taxes--the former as a necessity given the increased rate of poverty and joblessness in the district, the latter a means towards making our economic system more fair. Perhaps a victory like this, during a time when the national debate continues to be more focused on cutting benefits and services for the poor, will be a beacon for a reinvigorated national movement to attack our country’s appalling wealth inequality by taxing the rich.